Serving the Health Benefits Community

We take pride in empowering every stakeholder in the health benefits industry. Our innovative solutions and expert guidance ensure that everyone benefits from optimized cost containment and compassionate CARE.

Partner with The Phia Group for:

Technology-Powered Solutions

Access to Legal Expertise

NSA & IDR Support

Plan Document Language

Compliance Peace of Mind

Maximized Claim Recovery

Fiduciary Protection

Out-of-Network Repricing

Claims Issue Resolution

The Highest Level of Care

See how our services work together to unlock optimal savings and CARE.

Phia CARES

The services we offer to you are the same ones we use for our own employees—which means The Phia Group has a vested interest in creating highly successful cost containment solutions. As a testament to our services, we offer Free Health Benefits to our qualified employees and their families.

Cost Management

Advocacy

Resolution

Expertise

How We EMPOWER Plans and CARE for Families

From advocacy to expertise, The Phia Group combines everything needed to improve your cost containment while passionately supporting people every step of the way. We take care of your plans and families like they’re our own.

Joined The Phia Group in 2016

The Phia Ecosystem

Our services work together—or individually—to help you recognize your full cost containment potential.

The Phia Family

The Phia Group is continuously recognized as a top place to work. Our company culture is a reflection of the way we conduct ourselves with our clients and partners. When you work with us, you become a part of something bigger than a company—you are part of The Phia Family.

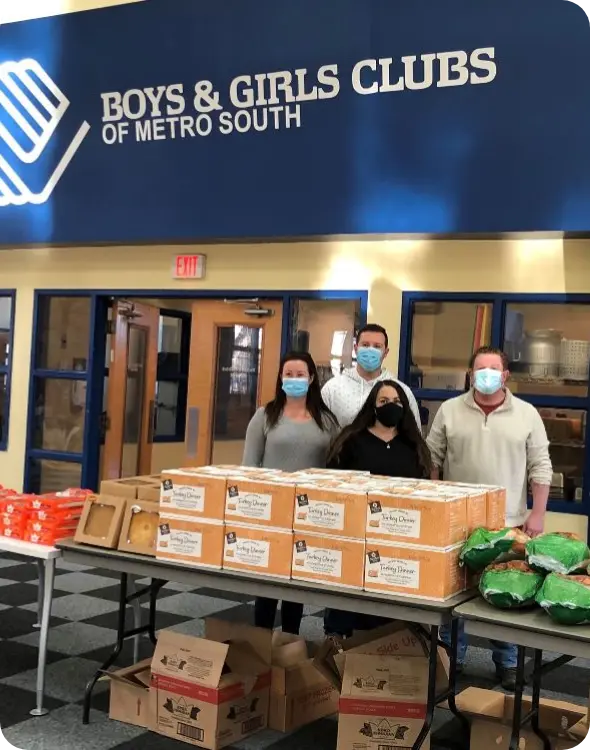

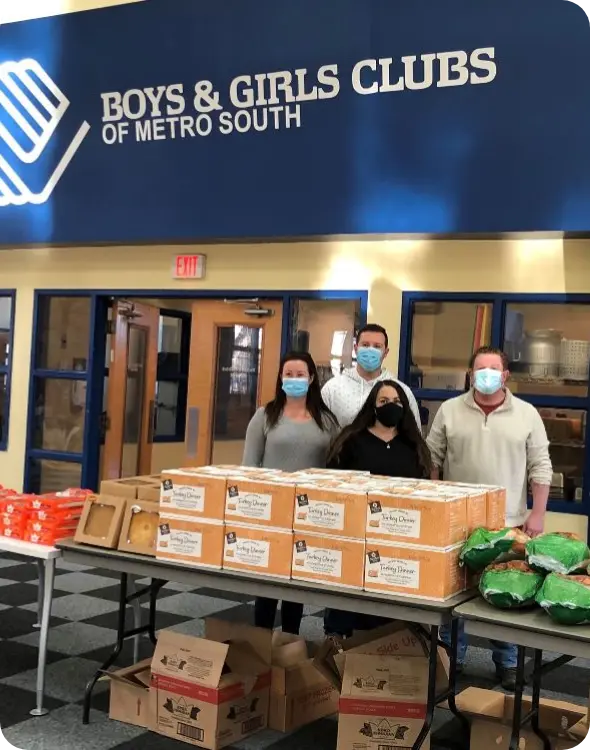

Caring For Our Community

The Phia Group has a deep commitment to helping our local community that spans the history of our company. Our work with Boys & Girls Clubs of Metro South is one of the ways we can ensure that as we continue to grow, we give back to those around us.

Want more information about our charity initiatives or how you can get involved with Boys & Girls Clubs of Metro South?

When Plans Win, So Do Families

We believe that everyone should have access to high-quality and justifiably priced care.

Contact us today to get started.

NOTICE: This form is not secure and not intended for communication of confidential information or Protected Health Information ("PHI") such as material regarding medical services you have or may receive, or your medical condition(s). If you have questions regarding a message you received from us, please contact our Customer Service Representatives toll-free at 888-986-0080.