The Phia Group’s 4th Quarter 2022 Newsletter

The Phia Group is off to a great start in the fourth quarter of 2022! Check out our newsletter to get acquainted with some of the latest happenings in our neck of the woods.

|

||

|

||

|

|

|

|

|

||

|

|

It’s fall here in New England; my second favorite time of the year. As we transition from the summer (my favorite time of year – for those wondering) to winter, many are saddened by what feels like an “end” of things… The end of a fun filled summer. The end of the year. Yet, I feel like autumn in Boston is more like a beginning. To me, it feels like an implementation of the holiday season. Halloween is the opening festivity or appetizer, followed by an incredible main course (Thanksgiving and Christmas), and concluding with New Year’s celebrations for dessert. I will admit I shed a tear when the pool was closed and the irrigation was locked down in anticipation of the inevitable cold and snow; but the anticipation itself is so exciting. |

|

|

The self-funded health benefits space is no different. This is the time when we get to work! This is when we hunker down, and really dig into renewal season. Plan document updates, innovative design changes, stop-loss reviews, new business closings and client retentions … all locked into place as we prepare for the new year! What could be more exciting? Nothing beats that “new plan smell…” Not even pumpkin spice lattes. Speaking of which, skip the coffee shops and orchards. There is no better place to get ready for new beginnings than here at The Phia Group. When it comes to what you need to do to retain existing clientele, attract new prospects, and supply all of them with the best performing most robust plans, we are way ahead of the rest. Yes, we are the ones that already have the Halloween decorations up, and our leaves raked and bagged. Additionally, we are also monitoring pending and proposed legislation and regulation, so that we can tell you what to look out for, and what to stay away from, in the coming months. In other words, we have already confirmed which houses are giving out the full size candy bars, and which are handing out the floss. So many of you – spanning from coast to coast – have already reached out to us to discuss and implement new strategies. Our organization – and I personally – am so grateful for you, your energy, and your enthusiasm … all of which makes this season, and this industry, so exciting. Just know that we are here for you. I hope you all enjoy this issue of the newsletter and as always. – Happy reading!

|

||

|

||

|

Enhancement of the Quarter: Proactive ICE Stop-Loss Policy Reviews The Phia Group prides itself on having enough experience in the industry to know what issues our clients are facing. With our Independent Consultation and Evaluation (ICE) service, we provide prepaid consultative services to help with all your self-funding needs; our ICE clients generally utilize this service a great deal, but there are certain issues brought to our attention that would be better taken care of before they arise. A perfect example is an unexpected stop-loss denial. In August, we undertook a large project to review stop-loss policies that our ICE clients send to us. If you are an ICE client, you have likely seen our emails with those reviews, and we hope they are helpful. Sending proactive policy reviews to all ICE clients is an enhancement to the service, designed to not only help TPAs, brokers, and health plans evaluate or vet a policy being pitched or renewed, but also to help provide information regarding which carriers’ policies may cause certain issues, and which don’t. We have never reviewed, read, or even heard of any stop-loss policy that didn’t contain some provisions that are actually or potentially problematic for a health plan, and we can tell you with confidence that even your preferred carriers’ policies have some language worth discussing to get ahead of an unexpected denial before it rears its ugly head. If you are a client of The Phia Group’s ICE service, feel free to send any policies you’d like reviewed to your dedicated ICE email address, and we will perform those reviews at no additional cost. This enhancement to the ICE service is meant to provide more than an ounce of prevention, and we’ve gotten great feedback so far. If you’re not an ICE client, feel free to send policies that need reviews to PGCReferral@phiagroup.com (or just become an ICE client, and there won’t be any additional cost!). Service Focuses of the Quarter: Plan Appointed Claim Evaluator (PACE) The Phia Group’s Plan Appointed Claim Evaluator (PACE) service was created as a way to help health plans and TPAs manage complex and very personal second-level appeals, and to ensure that fiduciary duties are satisfied by a neutral third party. PACE, a fiduciary transfer service for applicable final-level internal appeals, is designed to help the health plan ensure that appeals are handled in accordance with the law, thereby insulating the health plan against liability and allowing the employer to focus on what it does best. Among other benefits, plan document and stop-loss policy reviews and suggestions promote compliance, eliminate coverage gaps, and ensure PACE readiness. Through the PACE service, The Phia Group analyzes final-level internal appeals and renders a determination as fiduciary and obtains clinical review and access to URAC-accredited IROs as necessary, with all third-party review costs included. With the advent of the No Surprises Act, the appeals process has been turned on its head, and PACE is more important than ever as a tool to sort out the complex issues inherent in the new paradigm. Some grievances are treated in different and perhaps unexpected ways, and PACE is here to help figure it all out. We also offer PACE Certification, through which your organization can enhance your PACE understanding and utilization, improve your general internal appeals processes, learn how to better ensure regulatory compliance, and improve your business as a whole. To learn more, contact PACECertification@phiagroup.com. Success Story of the Quarter: Revealing Compliance Shortcomings With NQTL Analyses As you likely know, health plans subject to the Mental Health Parity and Addiction Equity Act are required to analyze the plan’s compliance with the MHPAEA and generate a report documenting compliance (or lack thereof) with respect to each nonquantitative treatment limitation (or NQTL) found within the plan. An NQTL is exactly what it sounds like: a limitation placed on treatment that is not readily quantifiable (an example being pre-certification requirements). Per the MHPAEA, a health plan is out of compliance if the plan applies any given NQTL more stringently to typical mental health or substance abuse disorder benefits than the plan applies the same NQTL to typical medical and surgical services. The law requires plans to analyze each NQTL not just in writing, but in operation as well – and sometimes the “in writing” and “in operation” pieces don’t quite match up, which is a problem for various reasons, not the least of which being MHPAEA compliance. In the process of performing an extensive NQTL analysis for a health plan, Phia’s team pored over the language of the plan document, a UM vendor’s written processes, and the UM vendor’s aggregate summary data for the prior plan year. In performing this analysis, one of Phia’s attorneys noticed that the three data points didn’t quite match up; it appeared that the UM vendor’s processes didn’t take into account the plan language, such that the plan language was not being applied as written – and then the aggregate data indicated that yet another set of standards was being used, other than the plan language and the vendor’s written processes. Not only were the vendor’s standard written processes noncompliant with the MHPAEA’s mandate of parity, but the existence of three different standards (one written by the plan, one written by the vendor, and one actually done by the vendor) presented not only an MHPAEA problem, but also an ERISA problem, since plan members were being given plan language that was not being followed. To make matters worse, the vendor was not even following its own written processes! Armed with this information, the plan was able to discuss the matter with its UM vendor, which is currently working to reconcile its written processes with its operational procedures – and the plan is working to update its plan document language to match the vendor’s updated written procedures (which the vendor has vowed to follow from now on!). Unfortunately, there is nothing the plan can do to rectify the compliance deficiency for the prior year, but taking good faith steps to cure a deficiency for future plan years goes a long way in the event of an audit. If you or a group need NQTL consulting or the analysis itself, please let us know via Phia-NQTL@phiagroup.com. Phia Case Study: Stop-Loss Isn’t Bound by the ACA! A TPA provided us with a stop-loss denial scenario where one of the TPA’s groups was required to pay a previously-denied claim as the result of the decision of an Independent Review Organization, the process created by the ACA all those years ago. Even though the plan’s language specifically stated that the plan would pay a claim if an IRO reversed a denial and explicitly directed the plan to pay, the plan’s stop-loss policy had no such allowance. That’s because even though the plan was required by law to pay a denied claim when directed by an IRO, the plan’s stop-loss carrier was under no such obligation, and the carrier had elected to not include any such allowance in its policy. The policy was a 12/12, and the spec claim was incurred in month seven of twelve, denied in month eight of twelve, but not reversed by the IRO until month thirteen of twelve. As a result, even if the carrier would have otherwise reimbursed the expense, the plan benefits weren’t paid until after the policy period had ended, and therefore there was no stop-loss coverage for the claim, one that the plan had no choice to pay at more than three times the specific deductible. Needless to say, the TPA and plan were not pleased. Phia was engaged to scour the file and contracts and try to find some loophole, but unfortunately stop-loss policy limitations are usually drafted very clearly, and this one was no different. We tried to negotiate with the carrier, but as soon as we saw the name on the paper, we knew they weren’t going to make any concessions. As a result of this large denial, the group threatened to leave the carrier, but the carrier still did not balk. The group wasn’t bluffing, though; the group directed its broker to shop around for policies, which the TPA promised it would have Phia review prior to being placed this time to avoid a similar situation in the future! Fiduciary Burden of the Quarter: “Avoiding Prohibited Transactions” As a consumer protection law, the No Surprises Act provides very little, if any, meaningful protection for health plans. Some interpret that to mean that Congress doesn’t care about health plans – but we believe that the NSA is simply meant to serve a different purpose, and insurers simply got caught in the crossfire of charges versus payment. Either way, we’ve got ample evidence that Congress in fact does care about health plans, including the recent update made to ERISA’s “prohibited transaction” rules. In sum, health plan vendors must disclose all compensation earned directly or indirectly from a health plan, and service agreements must give a health plan the opportunity to gauge the reasonableness of fees being charged and compensation being earned. While many consider this a no-brainer, there is a lot of grey area; the self-funded industry is full of complex and ill-defined relationships, which now may need to be better defined, in particular where compensation is concerned. Congress has seen fit to help protect health plans from those companies that service them. The typical health plan is often conceptualized as being relatively uninformed, often blindly following a TPA’s or broker’s advice without questioning vendors, fees, or services; Congress has imposed this transparency rule to protect even the most naïve health plan from hidden or ill-defined fees. Since health plans are required to account for their outgoing compensation, vendors are now required to explain and justify their incoming compensation. If you’re concerned that your TPA, broker or other vendor service agreement needs some work in this (or any other) regard, we can help! For more information, please contact your dedicated ICE email, or PGCReferral@phiagroup.com. • On September 15, 2022, The Phia Group presented, “A Prescription for Success? The Unknown Impact of Recent Legislation on Prescription Expenses,” in which the team discussed The Inflation Reduction Act, signed into law by President Biden, the recent Johnson & Johnson lawsuit involving patient assistance programs, and much more. • On August 18, 2022, The Phia Group presented, “Unfinished Business: Legal Fallout Leaves Plans in Limbo,” in which the team discussed the domino effect of the Supreme Court’s decision to overturn Roe v. Wade. • On July 19, 2022, The Phia Group presented, “Supreme Decisions – A Proactive Approach for Health Plans to Dobbs and Marietta,” in which we discussed landmark healthcare rulings that continue to reverberate across the country and our industry. Be sure to check out all of our past webinars!

Empowering Plans • On September 29, 2022, The Phia Group presented, “Conflicting Views on COVID: Is the Pandemic “Over”,” in which our hosts, Kelly Dempsey and Kevin Brady, discussed President Biden’s 60 Minutes interview that aired on Sunday, September 18, 2022. • On September 16, 2022, The Phia Group presented, “The Latest Developments Involving Patient Assistance Programs,” in which our hosts, Brady Bizarro and Andrew Silverio, discussed patient assistance programs. • On September 2, 2022, The Phia Group presented, “Is Wrongful Death the Death of a Subrogation Claim?,” in which our hosts, Chris Aguiar and Cindy Merrell, discussed the murky waters of wrongful death and healthcare subrogation claims. • On August 19, 2022, The Phia Group presented, “The (Healthcare) Times They Are A-Changin’,” in which our hosts, Nick Bonds and Corey Crigger, discussed two shifts in the healthcare landscape, the FDA’s stance on OTC hearing aids, and recent developments that show that not all debt is created equal, especially medical debt. • On August 5, 2022, The Phia Group presented, “Do You Mind (…The Gap)?,” in which our hosts, Jen McCormick and Jon Jablon, discussed the age-old topic of stop-loss gaps, with a modern twist. • On July 22, 2022, The Phia Group presented, “Should Plans Better Address Mental Health Benefits?,” in which our hosts, Ron E. Peck and Kaitlyn MacLeod, discussed what plans are doing to address the mental health crisis and how mental health parity comes into play for plans, patients, and providers. • On July 8, 2022, The Phia Group presented, “Stop Loss and Subrogation,” in which our hosts, Cindy Merrell and Chris Aguiar, discussed potential obligations of health plans to their stop-loss carriers in the event of a recovery through subrogation. • On July 1, 2022, The Phia Group presented, “The Dobbs Case – What Group Health Plans and Employers Need to Know,” in which our hosts, Ron E. Peck, Jen McCormick, and Brady Bizarro, discussed the U.S. Supreme Court’s decision to overturn Roe v. Wade and the sweeping implications for group health plans. Be sure to check out all of our latest podcasts! • BenefitsPro – How does the Inflation Reduction Act affect self-funded plans? – September 20, 2022 • Self-Insurers’ Publishing Corp. – Regulatory Recap: COVID-19 & The Ongoing Impact On Self-Funded Plans – August 4, 2022 • More Twists to the IDR Process in the No Surprises Act?. The latest final rule on the No Surprises Act has finally been released. • HHS Proposes Rules for 1557 Covered Entities. On July 25, 2022, HHS announced a proposed rule that would strengthen the protections granted by Section 1557 of the ACA in various contexts. • One Lesson We Must All Learn from Dobbs v. Jackson Women’s Health Organization. A lesson worth learning. • Marietta Memorial Hospital Employee Health Benefit Plan v DaVita Inc. – Dialysis Carve-Out. The framework for how plans can include language supporting well-drafted, neutrally applied dialysis carve-outs. To stay up to date on other industry news, please visit our blog. At The Phia Group, we value our community and everyone in it. As we grow and shape our company, we hope to do the same for the people around us. The Phia Group’s 2022 charity is the Boys & Girls Club of Metro South.

The mission of The Boys & Girls Club is to nurture strong minds, healthy bodies, and community spirit through youth-driven quality programming in a safe and fun environment. The Boys & Girls Club of Metro South (BGCMS) was founded in 1990 to create a positive place for the youth of Brockton, Massachusetts. It immediately met a need in the community; in the first year alone, 500 youths, ages 8 to 18, signed up as club members. In the 30-plus years since then, the club has expanded its scope exponentially by offering a mix of Boys & Girls Clubs of America (BGCA) nationally developed programs and activities unique to this club.

Since their founding, more than 20,000 youths have been welcomed through their doors. Currently, they serve more than 1,000 boys and girls ages 5-18 annually through the academic year and summertime programs. Phia News: Get to Know Our Employee of the Quarter: Sam Cox To be designated as an Employee of the Quarter is an achievement that is reserved for Phia employees who truly go above and beyond their day-to-day responsibilities. This person must not only transcend their established job description but also demonstrate dedication and passion to The Phia Group and its employees that is so unparalleled that it cannot go without recognition. The Phia Explore team has made the unanimous decision, without hesitation, that there is no one more deserving than our very own Sam Cox, The Phia Group’s 2022 Q3 Employee of the Quarter! Here is what one person had to say about Sam: “Sam is the definition of “above and beyond”. No one in Provider Relations works more diligently and unselfishly on everything she is involved with and for years has given 110% daily effort in everything she does for Provider Relations. She has been acting as department coordinator and intake for all Provider Relations Units. Recently with the passage of the NSA, she took on the responsibility of intake and coordinator on all new NSA claims which takes considerable organizational skills. All of these activities are not accomplished independently and all require constant communication and coordination with Phia’s clients.”

Congratulations Sam, and thank you for your many current and future contributions. Job Opportunities: • EDI Data Engineer • Accounts Receivable Specialist • Claim Analyst • Customer Service Rep • Case Investigator • Health Benefit Attorney • Provider Relations Coordinator See the latest job opportunities, here: Our Careers Page Promotions • Diana Newburg has been promoted from PACE Specialist to PACE Specialist II • Jamie Johnson has been promoted from Team Lead of Recovery Services to Manager of Recovery Services • Andrew Silverio has been promoted from Attorney II to Senior Attorney New Hires • Richard Hunt was hired as a Facilities Coordinator • Anthony Petrilli was hired as a Customer Service Representative • Matt Morrell was hired as a Project Coordinator • Maghen Keefe was hired as a PACE Appeal Specialist • Olivia Storey was hired as a Health Benefit Plan Consultant • Harman Singh was hired as a Software Engineer Intern • Alyssa Catalano was hired as a Customer Service Representative Energage Names The Phia Group a Winner of the 2022 Top Workplaces USA Award It is with great honor and humility that The Phia Group announces that it has earned a 2022 Top Workplaces USA award, issued by Energage. Energage, an organization that develops solutions to build and brand a vast array of companies, leveraged its 15-year history of surveying more than 20 million employees across 54 markets to award this prize. Earning this accolade was no small task. Several thousand organizations from across the country were invited to participate, and winners of the Top Workplaces USA were chosen based solely on employee feedback gathered through an employee engagement survey, issued by Energage. These results were then calculated by comparing the survey’s research-based statements, including 15 Culture Drivers that are proven to predict high performance against industry benchmarks. Cornhole Tournament and Phia BBQ It has become tradition at The Phia Group to celebrate the last day of summer with great games, food, and conversations. This year we invited all Phia employees to enter into our cornhole tournament. As you can see, we had a great turnout. The winners of the cornhole tournament were Julie Padden and Ujwal Shrestha. Congrats on the win, it was a close game!

Ice Cream at Phia The Phia family was visited by an all-you-can-eat ice cream truck a few times this past summer, and everyone in the office was excited to dive into the delicious treats. After a long day at work, there’s nothing better than biting into a delicious ice cream bar. The Phia family loved the variety of treats and were able to mingle outside on these beautiful days!

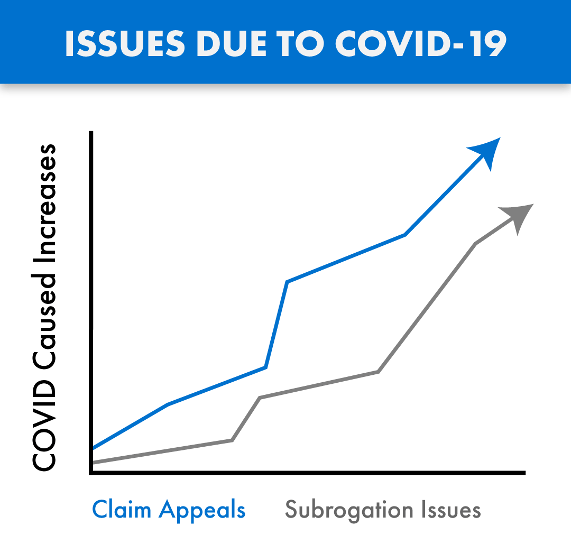

COVID claims are coming – whether you pay or deny claims tied to COVID, you need The Phia Group. Claims tied to the treatment of COVID-19 are being submitted for payment and are passing through the claims process in record numbers. Many of these claims are substantial, with these considerable costs impacting our industry in both anticipated and unforeseen ways. As with any influx of new claims, we are also seeing growth in the number of denials and appeals arising from these COVID claims, as well as subrogation issues tied to the disease. COVID claims are routinely denied and/or paid incorrectly, due in large part to the inadequate time provided to consultants, administrators, and payers, to familiarize themselves with the ever changing rules, and thereby standardize appropriate handling of these claims in accordance with law and their plan documents. As a result, we are also seeing an increase in COVID related claim appeals, with heightened fiduciary liability issues also arising from these claim payment decisions. The Phia Group’s PACE Service has existed for years and is the only service on the market where expert plan drafters, attorneys, and seasoned appeals professionals help you navigate these and other difficult appeals, thereby avoiding mistakes and costly liability. PACE ensures claim denials are legitimate, enforceable, and defended. As with claims processing and appeals, COVID has also created a new world for subrogation. When COVID claims are submitted, complex state law may be triggered regarding if and when COVID is “presumed” to be an occupational expense. The Phia Group was the first subrogation provider to build a custom process backed by its in-house legal team with a focus on identifying COVID related claims, determining whether the applicable geographic location and occupation are addressed by a regulation that presumes a link between the occupation and diagnosis, and quickly asserts a right to reimbursement against responsible parties if possible. The Phia Group has been applying this procedure to its existing process since June of 2020. Without an innovative subrogation solution like ours in place, plans not only lose money, but also fail in their obligation to stop-loss; a failure stop-loss carriers are increasingly unwilling to overlook. The stop-loss world has been handed a unique and difficult scenario. As it relates to claims arising from or tied to COVID-19, carriers are suspending reimbursement and asking questions such as: what is the Plan Participant’s job description; is the Plan Participant a front line worker; what date did they test positive; are they an essential worker; did they file a workers’ compensation claim; and so on. The Phia Group has the expertise to assist in these difficult stop-loss collaborations. Ensuring appeals are handled correctly, aligning plan documents with stop-loss policies, and fully understanding the bigger picture has never been more important. The Phia Group is uniquely positioned to help in this difficult time. With our unrivaled team and technology ready to help, there is no better partner to assist you now and in the days to come. Contact Garrick Hunt at ghunt@phiagroup.com or info@phiagroup.com to request more information and set a call to learn how The Phia Group can assist you with these COVID claim issues.

At The Phia Group, our commitment to fostering, cultivating, and preserving a culture of diversity and inclusion has not wavered from the moment we opened our doors 20 years ago. We realized early on that our human capital is our most valuable asset, and fundamental to our success. The collective sum of individual differences, life experiences, knowledge, inventiveness, innovation, self-expression, unique capabilities, and talent that our employees invest in their work, represents a significant part of not only our culture, but also our company’s reputation and achievements. We embrace and encourage our employees’ differences, including but not limited to age, color, ethnicity, family or marital status, gender identity or expression, national origin, physical and mental ability or challenges, race, religion, sexual orientation, socio-economic status, veteran status, and other characteristics that make our employees unique. The Phia Group’s diversity initiatives are applicable to all of our practices and policies, including recruitment and selection, compensation and benefits, professional development and training, promotions, social and recreational programs, and the ongoing development of a work environment built on the premise of diversity equality. We recognize that the success of our company is a direct reflection of each team member’s drive, creativity, diversity, and willingness to exercise initiative. With this in mind, we always seek to attract and develop candidates who share our passion for the healthcare industry and our commitment to diversity and inclusion.

|

||

|

||