The Phia Group’s 4th Quarter 2023 Newsletter

The Phia Group is off to a great start in the fourth quarter of 2023! Check out our newsletter to get acquainted with some of the latest happenings in our neck of the woods.

|

||

|

||

|

|

|

|

|

||

|

|

I feel rejuvenated and energized like I haven’t in decades! I know that those of you who have accused me of always being “too” energetic are laughing right now, wondering how I could possibly be even more amped-up, but I honestly feel like I did when I was 26 years old, and just starting this great company. Phia is entering a new stage of its growth and has created a new frontier for our offerings. For you – our loyal readers – I will let you in on a secret. Phia has been developing and will soon be marketing various tools and technology that are tied to, and will enhance, many of our existing services and products. Combined with our unrivaled legal expertise, I know this evolution will truly be a gamechanger. |

|

|

Just as I felt back in 2000 – when I was laboring over things that I knew would change the industry – so too today our team is grinding away, developing the “next big things,” fueled by a belief in something – a bigger overall mission and a true sense that we can again change the industry for the better. Make no mistake – The Phia Group isn’t alone in this regard. I’ve heard a lot of good speeches and read many amazing articles. I’ve seen parts of our market make drastic positive changes. Employers, plan administrators, and brokers all seem to be more aware and informed when it comes to the benefits of self-funding. They are more willing to be innovative, and not just rehashing the same old things. TPAs and the stop-loss market are likewise using technologies and becoming proactive when it comes to identifying new and emerging ways to reduce overall claim costs. While the industry may not be where it needs to be just yet, and our emphasis on quality metrics still hasn’t caught up to the clamor for “transparent pricing;” a fear of pharmaceutical miracles is blinding some to ways to contain costs with better overall plan designs; we are still in a much better spot overall than we were five years ago. So then … Why do I still have this weird feeling in my gut that, in many instances, our industry is stagnant (or even sliding backwards) despite all of the great things I just said? It is because we are not aligned. We do not all share a clear, and worthy mission! If we could all agree that our overarching goal must be to reduce the overall cost of health benefits by creating healthcare consumer awareness, emphasizing the value of quality outcome metrics, and addressing rising costs rather than trying to avoid them… we could all rise with the tide. In many ways, the fire and passion just isn’t there. My goal is to get that fire burning again; to build a bonfire, light new sparks in places that have been dark, dormant and cold for decades. Instead of just talking the talk, lets walk the walk. Lets not be happy with just 3% of self funded plans doing truly revolutionary and innovative things – Let’s get 100% of the industry wanting to create something special…different… and better. Just wait until you see what we have in store for you; jump on the train and lets go for the ride together. – Happy reading!

|

||

|

||

|

Service Focus of the Quarter: Phia Unwrapped Borne of The Phia Group’s nearly 25 years of dedicated expertise in managing out-of-network claims with an unwavering commitment to reducing healthcare costs for hard-working Americans, discover the transformative power of Phia Unwrapped. With the goal of harmonizing plan documents with claims pricing and No Surprises Act requirements, Phia Unwrapped is positioned as an industry front-runner, priding itself on averaging savings of 76% off billed charges thanks to proprietary technologies like the revolutionary Phia Ignite Repricing Engine and our customized PROS case management platform. The claim analysis processes that underly Phia Unwrapped combine considerations such as provider-specific analytics, acuity, quality of care, and applicable law, all culminating with a human touch. The best-in-class benchmarking data and technology that make up the foundation of Phia Unwrapped represent the convergence of excellence and innovation. What’s more, our team of nurse auditors, claims experts, attorneys, and consultants boasts a combined 200 years of claims settlement experience. Armed with experience, energy, and unmatched passion, Phia Unwrapped, and the team behind it, represents a revolution in healthcare cost-management and patient financial security. For more information, please contact Garrick Hunt at GHunt@phiagroup.com. Tech Talk: Ignite Pricing Engine We’ve recently unveiled this truly revolutionary pricing engine, built with Phia Unwrapped in mind. An AI-powered marvel that’s redefining healthcare savings already, even in its infancy, the Phia Ignite Pricing Engine seamlessly navigates the complexities of the No Surprises Act, promising not just savings, but a radical transformation. Phia Ignite isn’t just tech; it’s a mission. CEO Adam Russo declares, “We’re ensuring Americans get top-tier care without the top-tier price tag.” This is the latest success in Phia’s goal of Empowering Plans. Ready to experience the future of healthcare? Let the Phia Ignite Repricing Engine power your plans. Join the revolution now, and get a demo of Ignite today! For more information, please contact Garrick Hunt at GHunt@phiagroup.com. Phia Case Study A TPA client of Phia’s Independent Consultation and Evaluation (ICE) service presented the ICE team with a strange situation. A medical provider had administered an expensive experimental treatment to a plan participant. Upon the initial pre-certification request, a clerical error had resulted in pre-certification being granted. The pre-cert letter, as most do, indicated that pre-certification is not a guarantee of benefits. Upon submission of the finalized claim, the TPA denied it as experimental, which the provider and patient appealed vehemently. One point the provider raised is that though the pre-certification letter had a caveat about not being a guarantee of payment, the plan document itself had no such caveat, and instead indicated that if a service is pre-certified, the plan will cover it. Though the plan of course had an exclusion for experimental services, that exclusion contradicted the language providing for coverage of pre-certified claims. Whoever drafted this plan document overlooked the possibility that a grant of pre-certification may not have been correct, or that circumstances can change – and that oversight caused a questionable situation for this plan. The TPA represented that another hitch here is that the plan participant in question is the son of a C-suite member, and they were loathe to either deny the claim after the TPA had already pre-certified it or to overturn the denial and pay the claim what they felt would be improperly. The TPA felt it was caught between a rock and a hard place. What’s more is that if the plan did pay this claim, they knew that there was no way stop-loss would reimburse it, since it was, unequivocally, experimental. The plan wasn’t happy, and the TPA was worried about its own liability for the pre-certification error. Phia sprung into action. Our ICE team tackled the complex plan payment issues, including the risks associated with each potential approach; our Provider Relations team helped the TPA determine a strategy for negotiation (at the group’s request); and our plan drafting team suggested updates to the plan document to add clarity and otherwise update the plan’s payment mechanisms. Ultimately, Phia helped mitigate the provider’s frustration while laying the groundwork for a strong negotiation. Driven by the Ignite Pricing Engine, Phia helped the plan negotiate the claim to approximately 14% of billed charges, which the plan was more than happy to pay to make this go away for this VIP participant. Phia also ensured that the group updated its plan document to make sure this would never happen again. Plan Exposure: $102,550 TPA Exposure: Potentially, indemnification for $102,550, and loss of a longtime client group Phia Intervention Saved: $88,190, the group’s business, and the TPA’s behind Fiduciary Burden of the Quarter: Transparency! ERISA’s claims procedure rules are not always crystal clear in any given situation, but we know that the central theme is transparency and fairness. Health plans are not supposed to be able to game the system; since the ‘70s, federal law has provided broad protection for health plan participants as it relates to the handling of claims and appeals. Transparency is supposed to be at the forefront of a health plan’s claims and appeals adjudication. But is that really enough? There’s much more to health plan operations than how a health plan adjudicates and responds to claims, after all, and much of a health plan’s operational framework has gone virtually unchecked, becoming subject to scrutiny only when a specific complaint arose. Scratch that. Congress has changed the status quo. In 2020, Congress passed the Consolidated Appropriations Act, 2021, which thrusts transparency and reasonableness into the limelight by prohibiting “gag clauses”, by requiring plan vendors to eliminate opaqueness from their fees, by requiring not just compliance but proactive proof of compliance with the existing mental health parity rules, and, through the No Surprises Act, by protecting patients from balance billing and leveling the playing field of what is “reasonable” payment as far as providers and health plans are concerned. Transparency isn’t just a buzzword; it’s the new norm. Unfortunately, in addition to the inconvenience and resources needed to take the proactive steps necessary to comply with these parts of the Consolidated Appropriations Act, there are still a considerable number of unknowns – and yet enforcement seems to be in full swing! Lest we forget that health plans still need to avoid letting cost-containment falter in the wake of these significant compliance hurdles. There is no single explanation of how to manage all these complex transparency rules in any given case, but luckily, Phia’s Independent Consultation and Evaluation (ICE) service can be at your disposal to help overcome these and many other obstacles, all for – you guessed it – a transparent flat fee. For more information, please contact Garrick Hunt at GHunt@phiagroup.com. • On August 17, 2023, The Phia Group presented “A Duty to Serve and Protect … the Plan,” in which we discussed strategies applicable to every stage in a claim’s lifecycle, and best practices that will keep you out of the court house. • On July 11, 2023, The Phia Group presented “Illuminated by Phia Ignite! Leveraging A/I and Multifaceted Price and Quality Data,” in which we discussed case studies addressing regulatory compliance, claim appeals, and dispute resolution. Be sure to check out all of our past webinars!

Empowering Plans • On September 29, 2023, The Phia Group presented “Navigating the Gag Clause Prohibition,” in which our hosts, Jon Jablon and Kendall Jackson, discussed the issue of the gag clause prohibition, a mysterious law that continues to confound the self-funded industry. • On September 15, 2023, The Phia Group presented “Mass Torts 101” in which our hosts, Cindy Merrell and Lisa Hill, discussed the difference between the two types of mass tort cases — class action and multidistrict litigation (MDL) – while delving into a couple of the larger MDLs making news of late. • On August 31, 2023, The Phia Group presented “PSA on the NSA” in which our hosts, Brian O’Hara and Corey Crigger, discussed a case study highlighting the benefits of the Safeguard Program. • On August 17, 2023, The Phia Group presented “Let’s Keep Learning – Back to (Law) School,” in which our hosts, Kelly Dempsey and Corey Crigger, discussed renewal season preparation items and a variety of late breaking lawsuits that pertain to multiple aspects of the self-funded industry. • On August 4, 2023, The Phia Group presented ““Drafting” Plan Exclusions,” in which our hosts, Andrew Silverio and Kevin Brady, discussed the unanticipated costs of playing pickleball and then “draft” their favorite (and least favorite) plan limitations and exclusions. • On July 21, 2023, The Phia Group presented “Who is a Fiduciary and Does it Even Matter? Lawsuits Abound!” in which our hosts, Ron E. Peck and Jennifer McCormick, discussed recent lawsuits involving self-funded plan sponsors and their third party administrators, and accusations of fiduciary breach on the part of TPAs. • On July 7, 2023, The Phia Group presented “Delving Into Dobbs, One Year In,” in which our hosts, Nick Bonds and Kendall Jackson, discussed the changes that have occurred in the past year following the Supreme Court’s decision in Dobbs. Be sure to check out all of our latest podcasts! • Self-Insurers’ Publishing Corp. – 3M Mass Tort Settlement Reminds Us That Subrogation Matters – September, 2023 • BenefitsPro – Benchmarking medical prices with payer transparency files – August, 2023 • The First Ten: The Initial Round of Drugs Subject to Medicare Price Negotiations. Let the negotiations begin! • The Power Dynamics of Gag Clauses. Congress passed the Consolidated Appropriations Act, 2021, which is notable to the self-funded industry for three main reasons. • Wegovy: The Heart of the Matter. A weight loss drug that has more benefits than simply losing weight. • IDR Entities Still Struggling with Volume – Highlights from the Q4 2022 Report. The full report is certainly worth reviewing, but here are some noteworthy data points. • One Year Post-Dobbs Decision. It may be a year old now, but the Dobbs case seems as controversial now as it did the week it came out. To stay up to date on other industry news, please visit our blog. At The Phia Group, we value our community and everyone in it. As we grow and shape our company, we hope to do the same for the people around us. The Phia Group’s 2023 charity is the Boys & Girls Club of Metro South.

The mission of The Boys & Girls Club is to nurture strong minds, healthy bodies, and community spirit through youth-driven quality programming in a safe and fun environment. The Boys & Girls Club of Metro South (BGCMS) was founded in 1990 to create a positive place for the youth of Brockton, Massachusetts. It immediately met a need in the community; in the first year alone, 500 youths, ages 8 to 18, signed up as club members. In the 30-plus years since then, the club has expanded its scope exponentially by offering a mix of Boys & Girls Clubs of America (BGCA) nationally developed programs and activities unique to this club. Since their founding, more than 20,000 youths have been welcomed through their doors. Currently, they serve more than 1,000 boys and girls ages 5-18 annually through the academic year and summertime programs.

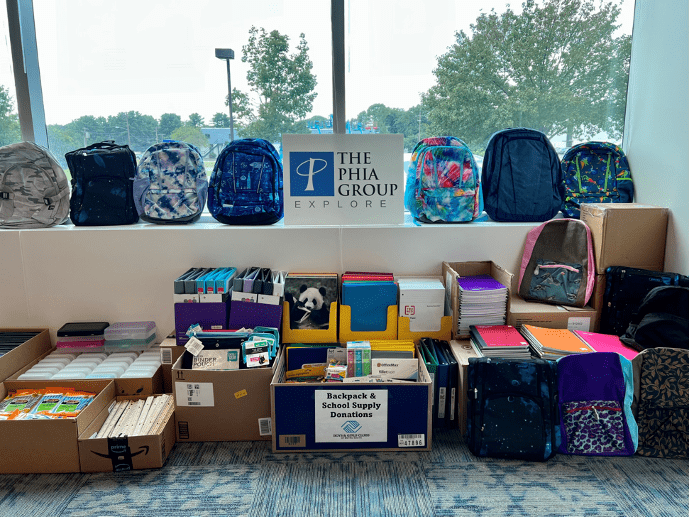

Backpack & School Supply Drive Our friends from the Boys & Girls Club of Metro South are going back to school, and the Phia Family wanted to send them some school supplies to go back to school with. The Phia family donated over $5,000 in school supplies! The kids were able to pick out a backpack, markers, glue sticks, pens, pencils, notepads, and so much more to help them succeed in school. In addition to the school supplies, Phia sent in a check for $10,000 to make sure any school supplies that the kids needed, they had. We hope all of the amazing children are enjoying their new school supplies!

The Boys & Girls Club of Kentuckiana Our Louisville team was out and about this past summer, volunteering at The Boys & Girls Club of Kentuckiana. They hosted a Water Wonderland event for the kids that included face painting, a water slide, sprinklers, water balloon/cannon games, and more. We hope you all had a great time and can’t wait to do it all again next year!

Phia News: Phia Made the Top Workplace USA 2023 List This award celebrates nationally recognized companies that make the world a better place to work together by prioritizing a people-centered culture and giving employees a voice. The Top Workplaces USA award is based entirely on feedback from an employee engagement survey completed by the employees of participating workplaces.

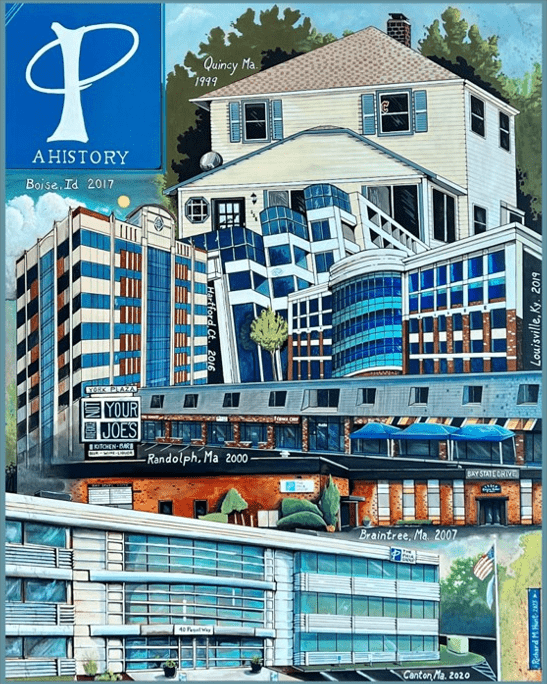

A Picture Worth a Thousand Words The Phia Group has well over 200 employees, many of whom have unique talents they exercise outside of work. One such employee is Facilities Coordinator Richard Hunt who this past August crafted a montage that brilliantly depicts our company’s different homes, both past and present. In a sense, Phia’s transition from being headquartered in the basement of CEO Adam V. Russo’s Quincy home to eventually settling in a massive Greater Boston office building mirrors the company’s upward trajectory in developing into a leader in the healthcare cost containment space. As is readily apparent from the accompanying image, Richard is, quite simply, an exceptionally gifted painter who is blessed with unparalleled attention to detail and creative sensibility. Because Richard’s masterpiece so perfectly chronicles our company’s history over the past quarter century, it now greets employees and visitors upon their arrival at our Canton, MA, office. While the elegance of the work is undeniable, its deeper message – how Phia has transformed and expanded its reach through the years – is masterfully conveyed. We are so proud of Richard’s crowning achievement and eternally grateful to have his artwork serve as a reminder of our unique history for all to see.

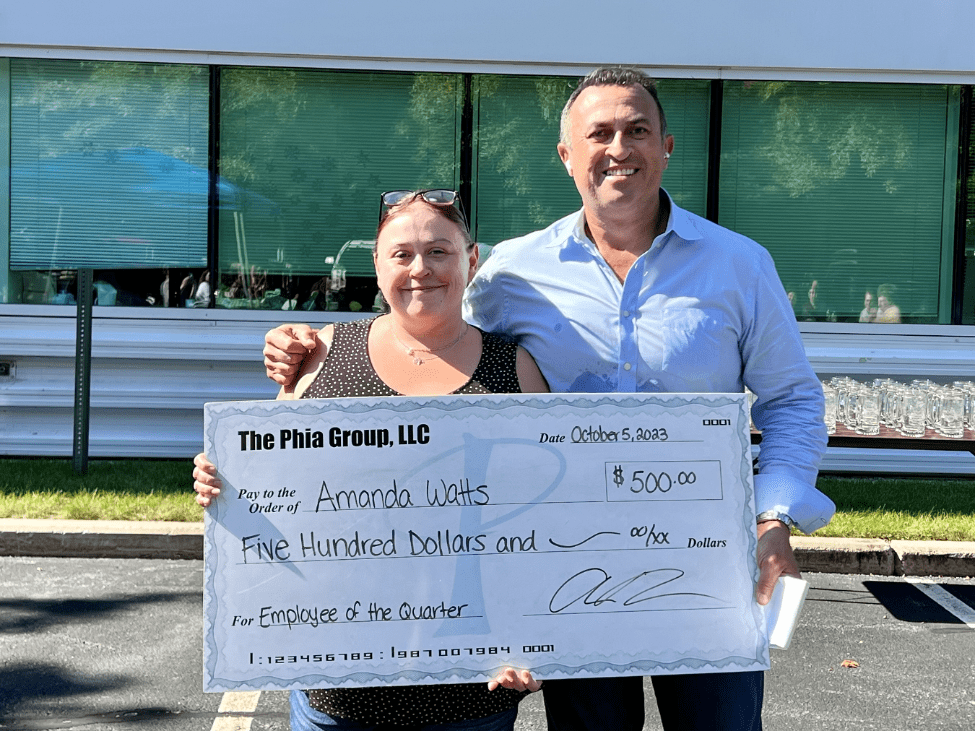

Being named Employee of the Quarter is an achievement that is for Phia employees who truly go above and beyond their responsibilities. This person must not only transcend their established job description but also demonstrate such unparalleled dedication and passion to The Phia Group and its employees that it cannot go without recognition. The Phia Explore team has unhesitatingly made the unanimous decision that there is no one more deserving than our very own Amanda Watts as The Phia Group’s 2023 Q3 Employee of the Quarter! Here is one person’s comments about Amanda: “Amanda has gone above and beyond facilitating client referral emails. Amanda has acted very professionally in time-sensitive, client-focused situations. She is the point person for CH, DSG, and CST. It is very intense as most of these cases are settling the moment we get the referral, so they are extremely time-sensitive. A large employer group was so impressed by our handling of another matter, they specifically reached out and asked us to handle another file. Amanda made this file a priority and had CS get the information, DSG check the pass file, and notified me (the CH) the case was ready to be worked. She did all of this extremely fast and with a smile. Her work facilitated a fast turnaround for an important group and client. This team member always goes above and beyond. We are extremely lucky to have her as a teammate.”

Congratulations Amanda, and thank you for your many current and future contributions. • Customer Care Representative • Case Investigator • Claim Analyst • Claim Recovery Specialist • Claim and Case Support Analyst • Subrogation Attorney See the latest job opportunities, here: Our Careers Page Promotions • Ethan Forrest has been promoted from Claim Investigator to Claim recovery Specialist IV • Lauren Pellegrino has been promoted from Claims Specialist to CRS Coverage, Training & Auditing Specialist New Hires • Chantelle Andrade-Browne was hired as a Claims Specialist. • Ben Nix was hired as a Client Success Account Executive. • Ralitsa Vega was hired as a Project Coordinator. • Rebecca Garfield was hired as a Claims Specialist. • Ivan Monteiro was hired as a Customer Service Rep. • Nancy Henderson was hired as a Sr. Project Manager. • Daniel Vital was hired as a Claim and Case Support Analyst. • John Gresh was hired as an Attorney. • Chloe Henderson was hired as a Plan Drafter. • Matt Kramp was hired as a Sr. Project Manager Data Services. • Matt Sanborn was hired as a Customer Service Representative. • Hannah Gray was hired as a Sr. Claim Recovery Specialist. Phia Attended the 2023 SIIA National Conference Several of Phia’s industry experts attended SIIA’s National Conference in Phoenix, Arizona, from October 8th – 10th. If you are interested in learning more about SIIA’s National Conference, visit their website today: SIIA 2023 Index.

At The Phia Group, our commitment to fostering, cultivating, and preserving a culture of diversity and inclusion has not wavered from the moment we opened our doors 20 years ago. We realized early on that our human capital is our most valuable asset, and fundamental to our success. The collective sum of individual differences, life experiences, knowledge, inventiveness, innovation, self-expression, unique capabilities, and talent that our employees invest in their work, represents a significant part of not only our culture, but also our company’s reputation and achievements. We embrace and encourage our employees’ differences, including but not limited to age, color, ethnicity, family or marital status, gender identity or expression, national origin, physical and mental ability or challenges, race, religion, sexual orientation, socio-economic status, veteran status, and other characteristics that make our employees unique. The Phia Group’s diversity initiatives are applicable to all of our practices and policies, including recruitment and selection, compensation and benefits, professional development and training, promotions, social and recreational programs, and the ongoing development of a work environment built on the premise of diversity equality. We recognize that the success of our company is a direct reflection of each team member’s drive, creativity, diversity, and willingness to exercise initiative. With this in mind, we always seek to attract and develop candidates who share our passion for the healthcare industry and our commitment to diversity and inclusion.

|

||

|

||