|

Enhancement of the Quarter: Phia Unwrapped & No Surprises Act Consulting

From COVID related expenses and processing issues, to expanded timeframes for providers to submit claims, few can deny that these are trying times for health plans and those that service them. With this as a backdrop, we were called upon once again to make sudden and severe adjustments in response to the impending No Surprises Act.

The Phia Group has been Empowering Plans since 2000, and twenty-one years later we continue our quest by providing Phia Unwrapped clients with No Surprises Act consulting included at no extra cost.

You may already know of Phia Unwrapped as a leading out-of-network claims management solution. We’re enhancing Phia Unwrapped, however, to make sure our clients are able to comply with the No Surprises Act’s requirements, as well as understand how to manage the requisite Independent Dispute Resolution (or IDR) process.

IDR is still a mystery to providers and health plans alike. Congress has laid out certain factors that may or may not be taken into account by the IDR arbiter, but still confusion abounds as to what will actually happen – and perhaps more urgently – what a health plan will need to do to properly defend its proposed payment.

The self-funded industry has changed every year, and the impending effective date of the No Surprises Act is slated to bring some of the biggest changes since the ACA. This year, and beyond, make sure you’re prepared to help your clients and bolster your business by providing the services health plans need. Our offer to provide complimentary consultative services, as it relates to this new and confusing rule, is extended to all current Phia Unwrapped clients, as well as those that become clients on or before September 1, 2021.

For more information on Phia Unwrapped, please contact our Senior VP of Provider Relations, Jason Davis, at jdavis@phiagroup.com.

Of course, if you’re not a Phia Unwrapped client, you can still get all the help you need by contacting PGCReferral@phiagroup.com – or, for clients of our Independent Consultation and Evaluation (ICE) service, via your dedicated ICE intake address.

_

Service Focus of the Quarter: PACE and Subrogation

In case you’re not familiar with The Phia Group’s Plan Appointed Claim Evaluator (PACE) service, it is designed to shift the fiduciary duty for second-level internal appeals to Phia, so the plan can ensure that a neutral third-party expert is the one making the most important appeal determinations.

You might think that the PACE service is completely unrelated to our subrogation and recovery services, but we don’t believe that’s the case. While the PACE service is designed to make sure the health plan and TPA have correctly adjudicated a given claim, our subrogation and recovery services focus not on the correctness of a payment, but on the correct coordination between the plan and any other applicable payors. Put simply, PACE helps the plan comply with its fiduciary duties (by removing the responsibility to adjudicate final-level appeals from the Plan Administrator to begin with), and recovery services help the plan recover money it has paid when another party is responsible. We think of these as two sides of the same coin: protection both before the appeals process is finalized (PACE), and protection after a claim is paid (recovery).

Over a year since the COVID crisis began, People are traveling again and living their lives. COVID claims are getting processed, are substantial in volume and cost, and are impacting our industry in unforeseen ways. COVID claims are routinely denied or paid incorrectly, since consultants, plans, and payors are faced with a larger-than-usual influx of claims due to the delayed claim and appeal submission timeframes allowed by the federal government. The Phia Group’s PACE service entails the utilization of attorneys, expert plan drafters, and seasoned appeals professionals to help you navigate these difficult appeals and avoid costly fiduciary liability. PACE ensures that plan determinations are defensible and accurate.

In addition, and not unexpectedly, COVID has created a new world for subrogation and coordination of benefits. When COVID claims are paid, complex state law is triggered regarding if and when COVID claims are, whether presumptively or not, an occupational expense. The Phia Group has built a custom process, backed by its in-house legal team. This process flags COVID claims, highlights the patient’s job (i.e. a first responder or front line worker), and cross references this information against up-to-date state laws. By focusing on identifying COVID health claims, and understanding applicable laws, we are able to quickly determine whether workers compensation or other responsible parties may exist for payment of said COVID claims. The Phia Group has been following this new process since June of 2020. Without an innovative subrogation solution in place, plans are needlessly losing money.

To learn more about the Plan Appointed Claim Evaluator service, subrogation/recovery, or any other services The Phia Group offers, please contact info@phiagroup.com.

Success Story of the Quarter: Reviewing Proposed Service Agreements

Using the COVID third-party liability identification tools (as described within the Service Focus of the Quarter section), The Phia Group identified a COVID claim for which an applicable Workers’ Compensation carrier should have paid as primary, but these particular claims were submitted only to the health plan, and not to Workers’ Compensation.

Using our considerable resources and time-tested strategies, we managed to identify a $210,000 payment made by the health plan, which we worked diligently to have the Workers’ Compensation carrier adjudicate and ultimately reimburse – resulting in a full recovery, and truly significant savings for the health plan.

Phia Case Study: Keeping PACE with Your COVID-19 Appeals

The Phia Group’s PACE team was recently presented with a final, second-level internal appeal from one of its clients. In this scenario, a plan member was required by her school to obtain a weekly negative COVID test in order to attend the school in person. A local hospital offered drive-through testing (which is exponentially less expensive than testing in a facility), but the member choose to obtain her tests in an emergency room setting, resulting in bills totaling about $11,000 per visit, for five visits.

The medical records, as expected, documented that these services were not in response to emergencies. Further, because the tests were in response to the school requiring it, rather than being in response to the member showing symptoms, they were not medically necessary. The health plan denied the initial claim and the first appeal, on that basis.

When the appeal reached the PACE team, it was analyzed from scratch, and a medical review was obtained. The PACE team reached the same conclusion as the Plan: despite the FFCRA and CARES Act, this testing was not required to be covered by the Plan, nor was the ER visit medically necessary. We appreciate that services were performed and that resources were expended by the emergency department, but that does not change the Plan’s unambiguous requirement of medical necessity as a condition of coverage.

The PACE team issued its directive accordingly, and the Plan could rest easy knowing that its previous denials were affirmed by an objective third-party, and that even if somehow overturned by a court or IRO (which we have no reason to expect), the Plan would not be liable for any penalties resulting from the overturned decision.

Fiduciary Burden of the Quarter: Knowing Whether You Are A Fiduciary

The law is fairly well-settled regarding when a TPA is a fiduciary, and when it is not. In general, fiduciary duties are ascribed to TPAs that exercise discretion or control over plan decisions, and TPAs that perform purely ministerial duties are generally not held to be fiduciaries. It’s essentially a rule akin to “if it walks like a duck…”.

Or so we thought…

A recent case out of the US District Court for the Northern District of California takes a slightly different approach than usual. In Jane Doe v. United Behavioral Health, No. 4:19-cv-07316 (N.D. Ca. March 5, 2021), the court does apply the full fiduciary status analysis that has been around for decades, but reaches a different conclusion. The issue in this case is that United Health, acting as the TPA, administered a provision of the Plan Document that is alleged to be in violation of federal law. The compliance issue is separate, but the facts of the case tend to indicate that United Health simply did exactly what the Plan Document requires, without exercising discretion.

Despite citing to controlling case law that “claims administrator does not exercise fiduciary responsibilities in the consideration of claims if it performs only administrative functions, processing claims within a framework of policies, rules, and procedures established by the employer”, this court somehow concluded that United Health is, in fact, a fiduciary, simply by virtue of being the one to make the decision. UnitedHealth argued that it didn’t actually make any decision, but instead simply communicated the decision that the Plan had required via the Plan Document – but the court wasn’t swayed, despite the virtual mountain of case law to support UnitedHealth’s argument.

Although this can be expected to reach the 9th Circuit Court of Appeals for review, something we all need to keep in mind is that the law is fluid, and different courts take different interpretations – and TPAs, brokers, and consultants can be considered fiduciaries even when they don’t expect it. Courts read precedent differently all the time; although we believe there is a good chance this will be reversed on appeal, we can’t say that for sure. As a result, we advise that whatever you do, do it well. If you act prudently and in good faith, there’s a very good chance that even if you are ultimately held to be a fiduciary, you will have satisfied your duties.

Webinars:

• On March 25, 2021, The Phia Group presented, “Fallout in the Spring – COVID Claim Disputes, Surprise Billing RBP Opportunities & Return to Work Vaccine Mandates,” where we discussed post-COVID era regulations applicable to benefit plans, as well as industry issues emerging from this new chapter in the pandemic saga.

• On February 25, 2021, The Phia Group presented, “A Blueprint for Success – Lessons from 2020, Expectations for 2021,” where we discussed President Biden’s first month in office, identify whom he has appointed for key roles (and examine their track records on healthcare), as well as dissect the issues that were most relevant in 2020.

• On January 20, 2021, The Phia Group presented, “The “No Surprises Act,” COVID Relief, and Plan Design Changes Impacting Your Business in 2021,” where we discussed the COVID-19 relief bill, the impact on the industry, and everything in between.

Be sure to check out all of our past webinars!

Breakout Sessions

• Following our March webinar, The Phia Group presented two breakout sessions, “Stop-loss Claims, Fiduciary Obstacles & COVID-19” and “Surprise Billing & RBP Opportunities.” If you would like a copy of the recording or slide deck, please reach out to, Matthew Painten, at mpainten@phiagroup.com.

• Following our February webinar, The Phia Group presented two breakout sessions, “Plan Document Evolution” and “Conflict & Compromise.” If you would like a copy of the recording or slide deck, please reach out to, Matthew Painten, at mpainten@phiagroup.com.

• Following our January webinar, The Phia Group presented two breakout sessions, “Plan Design Changes” and “Hot Topics in Claims.” If you would like a copy of the recording or slide deck, please reach out to, Matthew Painten, at mpainten@phiagroup.com.

Podcasts:

Empowering Plans

• On March 17, 2021, The Phia Group presented, “COVID-19 Vaccine Candidates – Vaccinating Vulnerable Populations,” where our hosts, Jen McCormick and Andi Goodman, discuss the future of vaccinating vulnerable populations such as pregnant women and children, and the importance of vaccinating children in achieving herd immunity.

• On March 2, 2021, The Phia Group presented, “One Step Forward; Two Steps Back – The Lockdown and its Effect on Children with Disabilities,” where our hosts, Garrick Hunt and Timothy Pope, hold a candid discussion about the harmful effects that the sweeping lockdown has had on families, and in particular on children with disabilities.

• On February 12, 2021, The Phia Group presented, “CYA: Cover Your Assets,” where our hosts, Nick Bonds and Brady Bizarro, talk through some developing trends in ERISA litigation.

• On February 4, 2021, The Phia Group presented, “Groundhog Day – A Year of COVID-19,” where our hosts, Brady Bizarro and Jen McCormick, have a conversation about the impact of COVID-19 on employers, health plans, and employees.

• On January 22, 2021, The Phia Group presented, “President Biden’s First 100 Days – What to Expect,” where our hosts, Ron Peck and Brady Bizarro discuss the inauguration of President Biden and what his presidency could mean for healthcare policy.

• On January 13, 2021, The Phia Group presented, “Balance Bills, Medical Tourism, and Vaccines – Oh My!,” where our hosts, Ron Peck and Corey Crigger discuss balance billing in the COVID world, medical tourism, and vaccine passports.

Be sure to check out all of our latest podcasts!

On apple podcasts

Back to top ^

Phia Fit to Print:

• BenefitsPro – The No Surprises Act: Taking control of rate-setting – March 31, 2021

• BenefitsPro – The No Surprises Act: When negotiations break down – March 30, 2021

• BenefitsPro – The No Surprises Act: What is a ‘surprise’? – March 29, 2021

• Self-Insurers Publishing Corp. – Pharmacy Deserts: A vicious cycle threatens to bottleneck vaccine rollout – March 5, 2021

• BenefitsPro – Born during a pandemic: COVID’s impact on pregnant employees and their employers – March 2, 2021

• Self-Insurers Publishing Corp. – Mental Health Parity Compliance In The ERA of COVID-19 – February 5, 2021

• BenefitsPro – The semi-resurrection of IRS Notice 2020-29 – January 26, 2021

• Self-Insurers Publishing Corp. – Supreme Court Upholds State Regulations of PBMS – Other Vendors Could Be Next – January 2, 2021

Back to top ^

From the Blogoshpere:

• A COBRA Conundrum! COBRA continuation coverage has never been intuitive.

• So the Outbreak Period Ended? In case you haven’t heard, the Employee Benefits Security Administration (EBSA) released Disaster Relief Notice 2021-01.

• HIPAA Compliance Audits – Good News and Bad News. The government recently released findings of the extensive HIPAA compliance audit performed in 2016 and 2017.

• Addition By Division. Learn all about what a “spinoff” is when it comes to health benefit plans.

• Choose Your Own Adventure: President Biden’s Healthcare Agenda. There are a few different outcomes for big developments the Biden administration is planning in the healthcare sector.

Back to top ^

The Phia Group’s 2021 Charity

At The Phia Group, we value our community and everyone in it. As we grow and shape our company, we hope to do the same for the people around us.

The Phia Group’s 2021 charity is the Boys & Girls Club of Metro South.

The mission of The Boys & Girls Club is to nurture strong minds, healthy bodies, and community spirit through youth-driven quality programming in a safe and fun environment.

The Boys & Girls Club of Metro South (BGCMS) was founded in 1990 to create a positive place for the youth of Brockton, Massachusetts. It immediately met a need in the community; in the first year alone, 500 youths, ages 8-18, signed up as club members. In the 25 years since, the club has expanded its scope exponentially by offering a mix of Boys & Girls Clubs of America (BGCA) nationally developed programs and activities unique to this club.

Since their founding, more than 20,000 youths have been welcomed through their doors. Currently, they serve more than 1,000 boys and girls ages 5-18 annually through the academic year and summertime programming.

Youth of the Year

Each year, the Boys & Girls Clubs of Metro South holds a competition to award the most prestigious honor that a teenager can receive as a member of their local Boys & Girls Club. The Youth of the Year award is the Boys & Girls Club signature effort to foster a new generation of leaders, fully prepared to live and lead in a diverse, global and integrated world economy.

One lucky teen will be awarded a $5,000 scholarship and a new laptop, courtesy of The Phia Group. The Boys and Girls Clubs of Metro South will announce the Boys & Girls Clubs of Metro South’s 2021 Youth of the Year on April 29, 2021. Make sure you check out our next newsletter to find out who won!

Phia Group Great Futures Scholarship

The Phia Group Great Futures Scholarship was established in 2018 by Adam V. Russo, Esq, co-founder and CEO, of The Phia Group. Once a Boys & Girls Club kid himself, Adam has set his mind and heart on supporting the ambitions of the Boys & Girls Club kids and their amazing potential. Adam realizes first-hand the struggles and challenges to overcome obstacles, facing adverse circmstances and the determination for self-perseverance. The Phia Group Great Futures Scholarship recognizes one graduating senior annually for their commitment to education and dedication to a better future. With Adam’s vision, the Boys & Girls Club of Metro South annually awards a $10,000 scholarship to assist one student in the pursuit of their educational dreams, development of strong work ethic, and development of self-appreciation. The Boys and Girls Clubs of Metro South will announce The Phia Group Great Futures Scholarship winner on April 29, 2021.

Back to top ^

Get to Know Our Employee of the Quarter:

Andrew Mead

To be designated as an Employee of the Quarter is an achievement that is reserved for Phia employees who truly go above and beyond their day to day responsibilities. This person must not only transcend their established job expectations, but also demonstrate with fervency a dedication to The Phia Group and its employees that is so unparalleled that it cannot go without recognition.

The Phia Explore team has made the unanimous decision, without hesitation, that there is no one more deserving than our very own Andrew Mead, The Phia Group’s 2021 Q1 Employee of the Quarter!

Andrew was hired as an intern about 6 months ago, with the intent to only stay with us until June. In his short time here he has made a pretty big impact on Phia… and people were not shy about letting Explore know! We received tons of feedback & outreach regarding Andrew this quarter, and brought it all to Adam’s attention. I am happy to announce that Andrew has been offered a full time position and starting May 3rd he will no longer be an intern! Congrats Andrew- we are very excited to have you as an “official” member of the Phia Phamily!

Congratulations Andrew, and thank you for your many current and future contributions.

Job Opportunities:

• Claim Recovery Specialist

• Case Investigator

• Legal Intern – Contracts

• Customer Service Representative

See the latest job opportunities, here: Our Careers Page

Promotions

• Hannah Sedman has been promoted from Legal Services Coordinator to Contracts Administration Manager

• Mattie Tigges has been promoted from Director of Recovery Services to Senior Director of Recovery Services

• Jennifer Armstrong has been promoted from Senior Subrogation Attorney to Director of Recovery Services

• Daiana Williams has been promoted from Manager of Recovery Services to Director of Recovery Services

• Andrew Fine has been promoted from Team Lead, Intake to Data Analyst, PGC

Phia News:

COVID – Appeals, Subrogation, and Stop Loss Issues No One Saw Coming – Help is Here

COVID claims are coming – whether you pay or deny claims tied to COVID, you need The Phia Group.

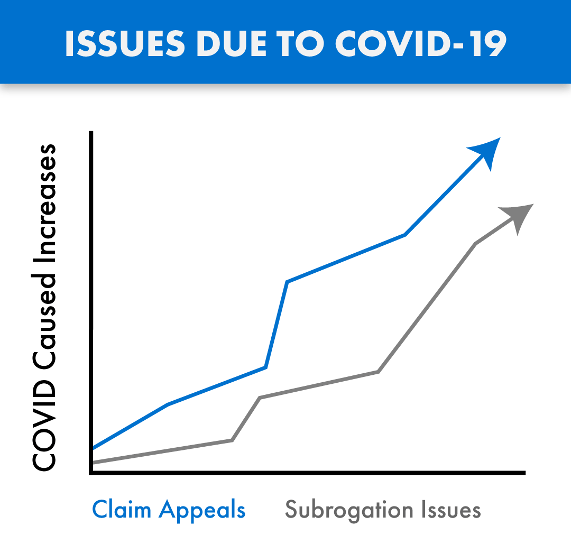

Claims tied to the treatment of COVID-19 are being submitted for payment and are passing through the claims process in record numbers. Many of these claims are substantial, with these considerable costs impacting our industry in both anticipated and unforeseen ways. As with any influx of new claims, we are also seeing growth in the number of denials and appeals arising from these COVID claims, as well as subrogation issues tied to the disease.

COVID claims are routinely denied and/or paid incorrectly, due in large part to the inadequate time provided to consultants, administrators, and payers, to familiarize themselves with the ever changing rules, and thereby standardize appropriate handling of these claims in accordance with law and their plan documents. As a result, we are also seeing an increase in COVID related claim appeals, with heightened fiduciary liability issues also arising from these claim payment decisions.

The Phia Group’s PACE Service has existed for years and is the only service on the market where expert plan drafters, attorneys, and seasoned appeals professionals help you navigate these and other difficult appeals, thereby avoiding mistakes and costly liability. PACE ensures claim denials are legitimate, enforceable, and defended.

As with claims processing and appeals, COVID has also created a new world for subrogation. When COVID claims are submitted, complex state law may be triggered regarding if and when COVID is “presumed” to be an occupational expense. The Phia Group was the first subrogation provider to build a custom process backed by its in-house legal team with a focus on identifying COVID related claims, determining whether the applicable geographic location and occupation are addressed by a regulation that presumes a link between the occupation and diagnosis, and quickly asserts a right to reimbursement against responsible parties if possible. The Phia Group has been applying this procedure to its existing process since June of 2020. Without an innovative subrogation solution like ours in place, plans not only lose money, but also fail in their obligation to stop-loss; a failure stop-loss carriers are increasingly unwilling to overlook.

The stop-loss world has been handed a unique and difficult scenario. As it relates to claims arising from or tied to COVID-19, carriers are suspending reimbursement and asking questions such as: what is the Plan Participant’s job description; is the Plan Participant a front line worker; what date did they test positive; are they an essential worker; did they file a workers’ compensation claim; and so on. The Phia Group has the expertise to assist in these difficult stop-loss collaborations.

Ensuring appeals are handled correctly, aligning plan documents with stop-loss policies, and fully understanding the bigger picture has never been more important. The Phia Group is uniquely positioned to help in this difficult time. With our unrivaled team and technology ready to help, there is no better partner to assist you now and in the days to come.

Contact Garrick Hunt at ghunt@phiagroup.com or info@phiagroup.com to request more information and set a call to learn how The Phia Group can assist you with these COVID claim issues.

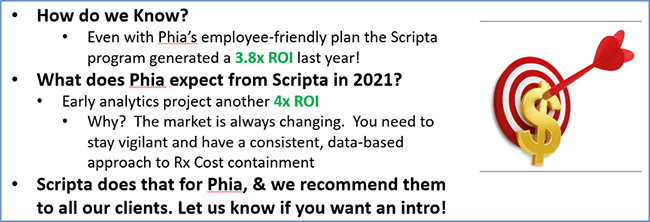

Scripta Going to Work for Phia

Scripta is a partner of The Phia Group that monitors plan participant spending on pharmaceutical drugs and devices. They identify unnecessary expenditures, inappropriate charges, and opportunities to replace or alter medications with equally effective – or more effective – options. Thanks to their services the Scripta program generated a 3.8x ROI for The Phia Group in 2020. Scripta expects at least a 4x ROI in 2021 as well.

Take a look at how The Phia Group is doing:

If you are interested in learning more about Scripta and how they can help your health plan, please contact our Sales Manager, Garrick Hunt, at 781-535-5644 or GHunt@phiagroup.com.

The Phia Group Reaffirms Commitment to Diversity & Inclusion

At The Phia Group, our commitment to fostering, cultivating, and preserving a culture of diversity and inclusion has not wavered from the moment we opened our doors 20 years ago. We realized early on that our human capital is our most valuable asset, and fundamental to our success. The collective sum of individual differences, life experiences, knowledge, inventiveness, innovation, self-expression, unique capabilities, and talent that our employees invest in their work, represents a significant part of not only our culture, but also our company’s reputation and achievements.

We embrace and encourage our employees’ differences, including but not limited to age, color, ethnicity, family or marital status, gender identity or expression, national origin, physical and mental ability or challenges, race, religion, sexual orientation, socio-economic status, veteran status, and other characteristics that make our employees unique.

The Phia Group’s diversity initiatives are applicable to all of our practices and policies, including recruitment and selection, compensation and benefits, professional development and training, promotions, social and recreational programs, and the ongoing development of a work environment built on the premise of diversity equality.

We recognize that the success of our company is a direct reflection of each team member’s drive, creativity, diversity, and willingness to exercise initiative. With this in mind, we always seek to attract and develop candidates who share our passion for the healthcare industry and our commitment to diversity and inclusion.

Back to top ^

|