|

Enhancement of the Quarter: Bundled No Surprises Act Consulting, and Patient Defender “Levels”

No Surprises Act Consulting

From COVID claims to expanded timeframes for providers to submit claims to the impending provisions of the No Surprises Act, few can deny that these are trying times for health plans and those that provide administrative and consulting services to them. Amidst this all, though, help is available. The Phia Group has been Empowering Plans since 2000, and twenty-one years later we continue our quest to do so by providing Phia Unwrapped clients with No Surprises Act consulting included at no extra cost.

You may already know Phia Unwrapped as a leading out-of-network claims management solution. We’re enhancing Phia Unwrapped, however, to make sure our clients are able to comply with the No Surprises Act’s requirements, as well as understand how to manage the impending Independent Dispute Resolution (or IDR) process.

IDR is still a mystery to providers and health plans, and the supplemental regulatory guidance issued on July 1, 2021 doesn’t even attempt to help unravel that mystery. Congress has laid out certain factors that may or may not be taken into account by the IDR arbiter, but still confusion abounds as to what will actually happen – and, perhaps more urgently, what a health plan will need to do to properly defend its payment offer.

This offer to include No Surprises Act consulting at no additional cost is extended to all current Phia Unwrapped clients, as well as those that become clients on or before September 1, 2021. For more information on Phia Unwrapped, please contact our Senior VP of Provider Relations, Jason Davis, at jdavis@phiagroup.com. Of course, if you’re not a Phia Unwrapped client, you can still get all the help you need by contacting PGCReferral@phiagroup.com – or, for clients of our Independent Consultation and Evaluation (ICE) service, via your dedicated ICE intake address.

Patient Defender “Levels”

In response to feedback from you – our valued clients and friends – we have revised our Patient Defender pricing model, to allow health plans to choose what “level” of service they would like, on a case-by-case basis. As a refresher, Patient Defender entitles a group, for a flat PEPM fee, to an attorney to represent patients in certain balance-billing scenarios. The Phia Group covers the attorney’s fee, so health plans and patients can feel secure in their reference-based pricing models.

We now offer three different levels, each with a different PEPM fee and each with a different threshold of balance-bill that will be handled by the pre-paid attorney. A TPA doesn’t need to decide up-front, either; an individual group can elect the option that is best tailored to its needs, and that option can even be changed at any time. This enhancement is designed solely to tailor the Patient Defender service to an individual group’s needs, and has been met with very positive feedback thus far.

To explore your Patient Defender options, please contact our Sales Manager, Garrick Hunt, at GHunt@phiagroup.com.

Service Focus of the Quarter: The MHPAEA NQTL Analysis

The Mental Health Parity and Addiction Equity Act (or MHPAEA) now requires health plans to “show their work” and perform a comprehensive NQTL analysis of the health plan itself. The analysis is no small task; even just knowing what information is needed is a chore.

At a high level, the MHPAEA does not require health plans to cover treatment for mental health or substance abuse disorders. If the health plan does cover that treatment, though, the MHPAEA requires generally that benefits not be more restricted for mental health and substance abuse disorder benefits than benefits provided for medical and surgical benefits. It’s not the honor system; the purpose of the NQTL analysis is to have health plans affirmatively demonstrate their compliance (or their non-compliance).

Whether the Department of Labor or a plan participant will request a copy of the analysis is anyone’s guess – but all health plans subject to the MHPAEA are required to perform the analysis nonetheless. In keeping with our perpetual goal of “Empowering Plans”, The Phia Group can help perform the NQTL analysis for your health plan, or those you service! Contact PGCReferral@phiagroup.com today to learn more.

Success Story of the Quarter: The $300k+ Balance Bill

One of The Phia Group’s balance-billing support clients had a member who suffered a stroke and was treated at a New Jersey hospital to the tune of $359,000. The Plan adjudicated its benefits of 140% of Medicare, which totaled just about $46,500. The member was balance-billed for the remainder, and the claim was then referred to The Phia Group.

In a case like this, where the billing is so much higher than a reasonable amount, our strategy is to start out with a forceful negotiation; the attorney handling this case offered $5,000 additional to settle (which totaled about 155% of Medicare). The provider didn’t respond for a couple of weeks, and the attorney working the file from Phia’s end was eventually given contact information for the individual in charge of negotiations at the hospital. The original offer of $5,000 was rejected, which was not unexpected for a first offer, but after establishing a positive rapport and having friendly but meaningful discussions about the claim, the plan’s rights, and the provider’s recourse, our attorney was able to settle the claim for additional payment of $17,343, or a total payment of about 192% of Medicare.

Through this negotiation, our attorney kept his cool, and he was able to discern that the provider would be receptive to a good attitude rather than a fight. Sometimes we do have to fight, of course – but an amicable relationship can often lead to the same or even better results, and this is a great example of that.

Phia Case Study: The Dialysis Overpayment

After a lack of clarity regarding which contract applied to a particular claim, one of The Phia Group’s clients discovered that one of its health plans had tendered payment to a DaVita dialysis facility in an amount far above the health plan’s allowable amount. When the TPA requested that the facility return the overpayment, DaVita refused. Phia was asked to attempt to recoup the overpayment; we knew from experience how difficult it can be to recover money from DaVita, especially once they had involved their attorneys, but we went into it with an open mind.

At first, we had very little luck. We argued the merits back and forth with the attorney, but no one would give an inch. Eventually, DaVita’s attorney made the plan a meager offer, which was better than the legally-required zero reimbursement, but still a pittance compared to the amount of the total overpayment. Phia advised its client of the offer, of course, but the plan decided to reject it.

One of the additional arguments Phia suggested had to do with considering DaVita to be a fiduciary with respect to the overpaid plan assets. The concept was a bit rough around the edges, since it isn’t quite supported by case law, but we had attorneys from multiple areas within Phia put their heads together, and we came up with an argument that at least sounded good. We presented the arguments to DaVita’s counsel, and without making any new counterarguments, we were able to reach a settlement figure that was acceptable to the plan.

We will likely never know what exactly spurred the ultimate overpayment recovery in this case (whether it was the persistence, or the creative fiduciary argument, or some combination of the two) – but this case study goes to show that even when a favorable outcome seems unlikely, some combination of persistence, a show of strength, and creativity can change the winds.

PACE Certification

Appeals and fiduciary requirements are a hot topic with all of the Consolidated Appropriation Act of 2021 mandates that are rolling out. You may want a better understanding of ERISA’s Claim and Appeals requirements, best practices, and the fiduciary role you might be playing unknowingly, we have created the PACE Certification course. You can take the course to become PACE Certified in the following areas. This course covers topics such as:

• The Growth of Self-Funding – The Good, The Bad and The Risky

• First Time Self-Funders; What You Need to Know

• Applicable Laws • Applicable Duties

• Trends in the Industry

• Fiduciaries and Appeals

• Types of Appeals

• Appeals 101

• Clerical Issues vs. Substantiative Issues

• Appeals Process and Best Practices

If you want to learn more about these topics, please contact us at: PACECertification@phiagroup.com

Fiduciary Burden of the Quarter: Cross-Plan Offsetting

Whether you are a TPA, broker, health plan, stop-loss carrier, or even a hospital, you are well aware that hospitals usually do not bill reasonably. In keeping with this habit, hospitals often refuse to return overpayments made by health plans; widespread common law support of a provider’s right to keep an overpayment (except in certain limited cases, such as a contractual overpayment or fraud) has proven very detrimental to payors.

In response, some health plans have begun to offset unreimbursed overpayments against future claims payable to that medical provider. This is fine if it is a claim for the same member as was involved in the overpaid claim (so long as the SPD supports it, that is). Some TPAs have taken it a step further, however, by having a different health plan deny a future claim for that same provider to account for the unreimbursed overpayment – a practice known as “cross-plan offsetting”. There is a bit of law on the topic, but not much; in general, courts do not take kindly to the practice when it comes before them, but we are yet to receive a sweeping general prohibition, nor do we have concrete guidance that the practice violates ERISA.

One major problem with cross-plan offsetting is that by denying future claims in response to an unreturned overpayment, the plan is making the assumption that the overpayment is legally recoupable. Unfortunately, with respect to the majority of overpayments, this country’s courts have been clear that that is not actually the case. Absent some dishonesty, fraud, or an incorrectly-paid contract rate, for instance, providers are legally entitled to keep overpaid plan funds, provided the payment is at or below the provider’s billed charges. Courts hold that the overpayment was actually made to the patient, since the money allegedly overpaid would have been the patient’s responsibility if it had not been paid by the plan. As a result, withholding future payment to the provider for a different patient, whether on the same or different health plan, is generally not a proper practice, since that different patient experiences a claim denial that is unrelated to his or her actual claim!

We have provided guidance on this many times in a consultative capacity, and one of our attorneys has blogged about it. The DOL itself has opined that cross-plan offsetting violates ERISA, and we tend to agree. In any event, we strongly caution TPAs and health plans against this practice. If you have any questions about a health plan’s or provider’s rights in a given scenario, please don’t hesitate to contact us at PGCReferral@phiagroup.com.

Webinars:

• On June 22, 2021, The Phia Group presented, “Back on Track: Plan Sponsor Priorities for the Second Half of 2021,” where we discussed some simple cost-containment solutions and plan document changes, as well as a few cutting-edge techniques to prepare you for the second half of the year.

• On May 25, 2021, The Phia Group presented, “The Light at the End of the COVID Tunnel – Pandemic Fallout and Permanent Changes,” where we discussed pandemic era regulations – such as ARPA and the American Families Plan, analyze employer “return to work” policies, as well as predict how the past year will impact the future – and cost – of health care.

• On April 27, 2021, The Phia Group presented, “Face the Change – Plan Design, Administrative Claims Processing and Payment Changes Needed in Light of COVID-19 and New Regulatory Obligations,” where we shared with you the information you need to remain compliant, while also predicting what the provider industry will look like in the months and years to come.

Be sure to check out all of our past webinars!

Breakout Sessions

• Following our June webinar, The Phia Group presented two breakout sessions, “Mental Health Parity – A Litigation Survey” and “FAQs on Prescription Drug Importation.” If you would like a copy of the recording or slide deck, please reach out to, Matthew Painten, at mpainten@phiagroup.com.

• Following our May webinar, The Phia Group presented two breakout sessions, “The Future Cost of COVID-19” and “Welcome Back; Not So Fast.” If you would like a copy of the recording or slide deck, please reach out to, Matthew Painten, at mpainten@phiagroup.com.

• Following our April webinar, The Phia Group presented two breakout sessions, “New Regulations Impose Additional MHPAEA Compliance Requirements – Act Now!” and “COBRA Changes Under ARPA – What You Need to Know.” If you would like a copy of the recording or slide deck, please reach out to, Matthew Painten, at mpainten@phiagroup.com.

Podcasts:

Empowering Plans

• On June 25, 2021, The Phia Group presented, “Healthcare Subrogation, The Comeback! Post-Covid Edition,” where our hosts, Cindy Merrell and Maribel Echeverry McLaughlin, discussed healthcare subrogation in the post-Covid environment, and the difficulties faced during the international pandemic.

• On June 11, 2021, The Phia Group presented, “Breaking Down Drug Importation!,” where our hosts, Chris Aguiar and Andrew Silverio, discussed some evolving issues and recent developments, including whether a participant can be deemed a plan fiduciary after a third party recovery, and the current state-run of state drug importation programs.

• On May 27, 2021, The Phia Group presented, “NQTL? MHPAEA?! OMG, IDK!,” where our hosts, Nick Bonds and Jon Jablon, discussed one of the most mysterious topics of the CAA: the Non-Quantitative Treatment Limitation analysis now required by the Mental Health Parity and Addiction Equity Act.

• On May 14, 2021, The Phia Group presented, “The Unanticipated Costs of COVID-19 Testing,” where our hosts, Kelly Dempsey and Kevin Brady, revisited a subject quite popular at the beginning of the pandemic; testing for COVID-19.

• On May 11, 2021, The Phia Group presented, “A Win/Win Proposition – Better Quality for Patients, Real ROI for Plans,” where our hosts, Tim Callender and Linda Pestant, are joined by the CEO and Co-Founder of Rightway Healthcare, Jordan Feldman, to discuss how Rightway is making an impact!

• On April 30, 2021, The Phia Group presented, “Updates Employers Need to Know About the COVID-19 Vaccines,” where our hosts, Brady Bizarro and Philip Qualo, had a conversation about compliance considerations implicated when considering mandating vaccination.

• On April 16, 2021, The Phia Group presented, “A No-Surprises Party – The No Surprises Act Dissected,” where our hosts, Ron Peck and Jen McCormick, discussed the No Surprises Act, its likely impact on both the payer and provider industries, and provide listeners with guidance on what they need to do now, to ensure compliance when it goes live.

• On April 6, 2021, The Phia Group presented, “The Mystery Surrounding COVID-19 Long Haulers: Employment & Benefit Considerations,” where our hosts, Phil Qualo and Kelly Dempsey, explored the phenomena surrounding COVID-19 long haulers.

Be sure to check out all of our latest podcasts!

Back to top ^

Phia Fit to Print:

• Self-Insurers Publishing Corp. – Pension Ruling Limits Health Plan Mismanagement Cases – June 4, 2021

• BenefitsPro – Vaccine patent waivers: A roadblock on the path to normalcy – June 2, 2021

• Self-Insurers Publishing Corp. – The Pandemic May Be On The Back Nine; But What About its Impact – May 7, 2021

• BenefitsPro – No Surprises Act: Practical effects of independent dispute resolutions – April 20, 2021

Back to top ^

From the Blogoshpere:

• Good to Be Back! Getting back into the swing of things.

• MHPAEA Compliance: The Dreaded NQTL Analysis. The Mental Health Parity and Addiction Equity Act (or MHPAEA) now requires health plans to “show their work.”

• The New Normal… Same as the Old Normal? The halfway mark of 2021 is a great time to examine the last year and a half.

• Revisiting PPO Contracts & Stop-Loss Gaps. Stop-loss policy gaps can arise anywhere – even from basic policy definitions.

• Doe v. United Behavioral Health – A Fiduciary Twist. A lawsuit brought against a TPA could have a fiduciary ripple effect on TPAs in California and beyond.

To stay up to date on other industry news, please visit our blog.

Back to top ^

The Phia Group’s 2021 Charity

At The Phia Group, we value our community and everyone in it. As we grow and shape our company, we hope to do the same for the people around us.

The Phia Group’s 2021 charity is the Boys & Girls Club of Metro South.

The mission of The Boys & Girls Club is to nurture strong minds, healthy bodies, and community spirit through youth-driven quality programming in a safe and fun environment.

The Boys & Girls Club of Metro South (BGCMS) was founded in 1990 to create a positive place for the youth of Brockton, Massachusetts. It immediately met a need in the community; in the first year alone, 500 youths, ages 8-18, signed up as club members. In the 25 years since, the club has expanded its scope exponentially by offering a mix of Boys & Girls Clubs of America (BGCA) nationally developed programs and activities unique to this club.

Since their founding, more than 20,000 youths have been welcomed through their doors. Currently, they serve more than 1,000 boys and girls ages 5-18 annually through the academic year and summertime programming.

Youth of the Year

Each year, the Boys & Girls Clubs of Metro South holds a competition to award the most prestigious honor that a teenager can receive as a member of their local Boys & Girls Club. The Youth of the Year award is the Boys & Girls Club signature effort to foster a new generation of leaders, fully prepared to live and lead in a diverse, global and integrated world economy.

One lucky teen was awarded a $5,000 scholarship and a new laptop, courtesy of The Phia Group. The Boys and Girls Clubs of Metro South has announced the Boys & Girls Clubs of Metro South’s 2021 Youth of the Year winner, Victoria Rodriguez! Best of luck in your future endeavors.

Phia Group Great Futures Scholarship

The Phia Group joined the Boys & Girls Club community in 2016 as a way to enhance great futures. The Great Futures Scholarship was established in 2018 by Adam V. Russo, Esq, co-founder and CEO, of The Phia Group. Once a Boys & Girls Club kid himself, Adam has set his mind and heart on supporting the ambitions of our club kids and their amazing potential. Adam realizes first-hand the struggles and challenges to overcome obstacles, facing adverse circumstances, and the determination for self-perseverance.

The Great Futures Scholarship recognizes one graduating senior annually for their commitment to education and dedication to a better future. With Adam’s vision, the club annually awards a $10,000 scholarship to assist one student in their pursuit of their educational dreams, development of strong work ethic, and development of self-appreciation. The Boys and Girls Clubs of Metro South has announced The Phia Group Great Futures Scholarship winner, DeeJay Lamarre! Congratulations and best of luck in College!

Back to top ^

Get to Know Our Employee of the Quarter: Brittany Farr

To be designated as an Employee of the Quarter is an achievement that is reserved for Phia employees who truly go above and beyond their day to day responsibilities. This person must not only transcend their established job expectations, but also demonstrate with fervency a dedication to The Phia Group and its employees that is so unparalleled that it cannot go without recognition.

The Phia Explore team has made the unanimous decision, without hesitation, that there is no one more deserving than our very own Brittany Farr, The Phia Group’s 2021 Q3 Employee of the Quarter!

Here is what one person had to say about Brittany: “Every single time I reach out to CSD, not only is Brittany usually the first person to say they can help me out, but she is SUPER helpful, responsive, and very professional. This isn’t to say that most of the new people haven’t been helpful or responsive, but I just think that Brittany has always gone the extra mile for me since she started.”

Congratulations Brittany, and thank you for your many current and future contributions.

Job Opportunities:

• ETL Specialist

• Legal Assistant

• Case Investigator

• Customer Service Representative

• Claim Analyst

• Claim & Case Support Analyst

• Senior Vice President of Sales

See the latest job opportunities, here: Our Careers Page

Promotions

• Andrew Fine has been promoted from Team Lead of Intake to Consulting Data Analyst

• Ron E. Peck has been promoted from Executive VP & General Counsel to Chief Legal Officer

• Nicole Capozzoli has been promoted from Case Investigator to Claim Recovery Specialist III

• Francesca Russo has been promoted from Claims Recovery Specialist IV to Senior Claims Recovery Analyst

• Kevin Brady has been promoted from Staff Attorney to Attorney II

• Kelsey Dillon has been promoted from Sr. Claim & Case Support Analyst to Team Leader – Claim & Case Support

• Kaitlyn Lucier has been promoted from Customer Care Representative to Team Leader – Customer Service

New Hires

• Peter Kotsifas was hired as the Chief Financial Officer

• Katie Duke was hired as a Legal Intern

• Adam Czyrklis was hired as a Case Investigator

• Samantha Crawford was hired as a Case Investigator

• Nicole Hunt was hired as a Case Analyst

• Amanda Watts was hired as a Customer Service Rep.

• Tika Green was hired as a Customer Service Rep.

• Veronica Marcos was hired as a Contracts Intern

• Caitlin Lankston was hired as an IT Consultant

• Sandra Croteau was hired as a CST Manager

• Petra Holder was hired as a Customer Service Rep.

• Michael Guthrie was hired as a DSG Consultant

• Anna Montalto was hired as a Marketing Intern

Phia News:

Best Place to Work in Greater Louisville

The Phia Group is proud to announce that it has earned a Best Places to Work in Greater Louisville award, issued by Louisville Business First. The Best Places to Work program—administered in partnership with Quantum Workplace—surveys employees about workplace policies, office conditions, management styles, morale, and more. The Phia Group is humbled to be one of only 43 businesses and nonprofits, with at least 10 full-time employees and an office in the Louisville area, that scored high enough to be awarded.

The Phia Group only recently opened its Louisville office, but it already houses some of the company’s most valuable team members. Thanks to the talent and passion found in Louisville, along with this recognition, The Phia Group plans to continue its steady growth in the Louisville area.

COVID – Appeals, Subrogation, and Stop Loss Issues No One Saw Coming – Help is Here

COVID claims are coming – whether you pay or deny claims tied to COVID, you need The Phia Group.

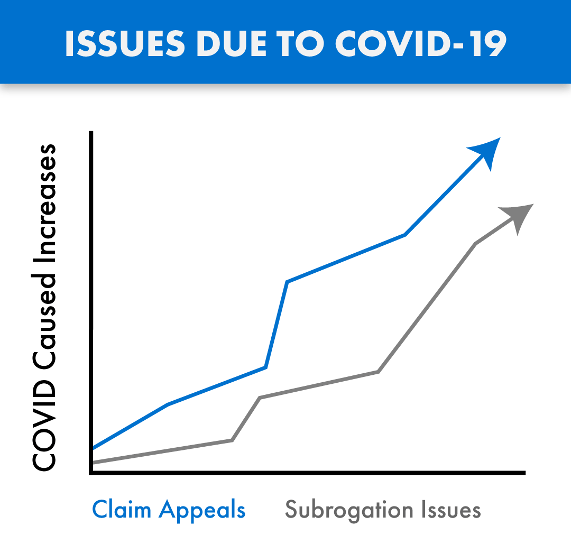

Claims tied to the treatment of COVID-19 are being submitted for payment and are passing through the claims process in record numbers. Many of these claims are substantial, with these considerable costs impacting our industry in both anticipated and unforeseen ways. As with any influx of new claims, we are also seeing growth in the number of denials and appeals arising from these COVID claims, as well as subrogation issues tied to the disease.

COVID claims are routinely denied and/or paid incorrectly, due in large part to the inadequate time provided to consultants, administrators, and payers, to familiarize themselves with the ever changing rules, and thereby standardize appropriate handling of these claims in accordance with law and their plan documents. As a result, we are also seeing an increase in COVID related claim appeals, with heightened fiduciary liability issues also arising from these claim payment decisions.

The Phia Group’s PACE Service has existed for years and is the only service on the market where expert plan drafters, attorneys, and seasoned appeals professionals help you navigate these and other difficult appeals, thereby avoiding mistakes and costly liability. PACE ensures claim denials are legitimate, enforceable, and defended.

As with claims processing and appeals, COVID has also created a new world for subrogation. When COVID claims are submitted, complex state law may be triggered regarding if and when COVID is “presumed” to be an occupational expense. The Phia Group was the first subrogation provider to build a custom process backed by its in-house legal team with a focus on identifying COVID related claims, determining whether the applicable geographic location and occupation are addressed by a regulation that presumes a link between the occupation and diagnosis, and quickly asserts a right to reimbursement against responsible parties if possible. The Phia Group has been applying this procedure to its existing process since June of 2020. Without an innovative subrogation solution like ours in place, plans not only lose money, but also fail in their obligation to stop-loss; a failure stop-loss carriers are increasingly unwilling to overlook.

The stop-loss world has been handed a unique and difficult scenario. As it relates to claims arising from or tied to COVID-19, carriers are suspending reimbursement and asking questions such as: what is the Plan Participant’s job description; is the Plan Participant a front line worker; what date did they test positive; are they an essential worker; did they file a workers’ compensation claim; and so on. The Phia Group has the expertise to assist in these difficult stop-loss collaborations.

Ensuring appeals are handled correctly, aligning plan documents with stop-loss policies, and fully understanding the bigger picture has never been more important. The Phia Group is uniquely positioned to help in this difficult time. With our unrivaled team and technology ready to help, there is no better partner to assist you now and in the days to come.

Contact Garrick Hunt at ghunt@phiagroup.com or info@phiagroup.com to request more information and set a call to learn how The Phia Group can assist you with these COVID claim issues.

The Phia Group Reaffirms Commitment to Diversity & Inclusion

At The Phia Group, our commitment to fostering, cultivating, and preserving a culture of diversity and inclusion has not wavered from the moment we opened our doors 20 years ago. We realized early on that our human capital is our most valuable asset, and fundamental to our success. The collective sum of individual differences, life experiences, knowledge, inventiveness, innovation, self-expression, unique capabilities, and talent that our employees invest in their work, represents a significant part of not only our culture, but also our company’s reputation and achievements.

We embrace and encourage our employees’ differences, including but not limited to age, color, ethnicity, family or marital status, gender identity or expression, national origin, physical and mental ability or challenges, race, religion, sexual orientation, socio-economic status, veteran status, and other characteristics that make our employees unique.

The Phia Group’s diversity initiatives are applicable to all of our practices and policies, including recruitment and selection, compensation and benefits, professional development and training, promotions, social and recreational programs, and the ongoing development of a work environment built on the premise of diversity equality.

We recognize that the success of our company is a direct reflection of each team member’s drive, creativity, diversity, and willingness to exercise initiative. With this in mind, we always seek to attract and develop candidates who share our passion for the healthcare industry and our commitment to diversity and inclusion.

Back to top ^

|